Nick Ray Ball — Author & Designer of S-World AGI

S-World™

Congratulations Rishi Sunak

From Nick Ray Ball on October 25, 2022

Member of the Conservative Party

Epsom and Ewell #5300 73501

To celebrate your assent to Prime Mister, I wrote the following paper — The first of three that will help the country we love.

Why High Inflation is a Positive for the UK Debt-to-GDP Ratio

Dear Rishi,

I have written a paper for you and the bank of England and sent it to rishi.sunak.mp@parliament.uk

It will of course get lost in the noise, but it will get to you eventually.

You can download the paper at the following link:

https://nickrayball.com/13.77__How-to-Frame-Inflation-as-a-Positive-for-the-UK-Debt-to-GDP-Ratio__(Oct_25_2022).pdf

And you can download the two accompanying spreadsheets by clicking on the following links:

https://nickrayball.com/13.77__How-to-Frame-Inflation-as-a-Positive-for-the-UK-Debt-to-GDP-Ratio--Spreadsheet__(Oct_25_2022).xlsx

https://nickrayball.com/The-Kobayashi-Maru-GDP-GAME.xls

Cheers and good luck,

Nick Ray Ball, 21.48 London Time, October 25, 2022

Conservative Member: 53000 73501

How to Frame Inflation as a Positive for the UK Debt-to-GDP Ratio

By Nick Ray Ball October 25, 2022

For Rishi Sunak, Rupal Patel, Jack Meaning & The Bank of England

First and foremost, I am not saying inflation is good, I am simply laying out the reasons why it's not as bad as is reported and giving you a better way to frame it to the media, bankers, politicians and the public at large.

Today I am writing the first of three papers and an introduction to S-World UK Butterfly AGI, inspired by a commiserations letter I wrote to Liz Truss on Friday, Oct 20, 2022.

The working titles of the other two papers are important for contenx, they are;

- S-World AGI – UK Butterfly – How to score a perfect 4x on the Keynes Multiplier, without any arguments.

- Loss Aversion in UK Politics and the Media.

You may read the quickly written letter I wrote Liz Truss at this link..

So to business then and the first of the three papers; Why High Inflation is a Positive for the UK Debt-to-GDP Ratio.

What I’m presenting is not in any way controversial, it is textbook economics, but with a loss-averse media favouring bad news, and the 3rd rule of macroeconomics being expectations, it has been either overlooked or sat on.

I know much more about US economics than UK economics, but for now, let us assume the similarities are true in this instance.

The USA never paid off its second world war debt, it just got inflated away, as a very small number within a much larger one. So in terms of the important debt-to-GDP ratio, which in turn is a major signal to lenders – inflation is good.

I’m not saying it is desirable, but I will say that if it’s a global problem or a Western problem at least, then no matter the cause (too much QE, Energy Prices, a general readjustment due to lower wages in the developing world, et al.) There is only so much that the UK government and the BOE can do about it. Maybe one can move it up or down 1%, but that will not make a great deal of difference to the global/Western situation.

My point is that there is not a great deal that can be done after fiscally responsible coordinated government and BOE actions have been deployed, as seems now on the cards. So instead of running from the problem, why not create a media-focused positive inflation strategy? By refarming inflation as presented.

On Friday I wrote some very quick numbers on a spreadsheet that draw on some further basic assumptions. You can download the spreadsheet here.

1. If GDP only increases in real terms of Output by 1%. Then the debt-to-GDP ratio would stay the same, but as GDP is measured by the cost of items, if the cost increases by 10% a year for 3 years and the cost is pro rata averaged out across the economy then the cost of all items would be 30% more + 3% for the 3 1% years of growth, plus a little more for the compound nature of these things so a 33%+ increase to the cost of all output and so a 33% increase to GDP? (Note the deliberate question mark here, it is a statement, but it can be improved upon by specialists.)

A touch of post-script research and I remember there is both nominal GDP in which inflation is not factored and real GDP where it is. See Investopedia.com Real GDP - so in the above, I am describing nominal GDP, whereas when historical GDP curves over the last 100 years which steadily rise at an almost predictable rate use real GDP (inflation-adjusted GDP), and so stagflation is in terms of real GDP, and my assessment is based on stagflation, so in the real world, the debt-to-GDP ratio will be even lower than my figures suggest as I cautiously only put in 1% for real GDP whereas it will likely be closer to 1.5% or more when you average out 2023, 2024 and 2025.

2. For now, let us ignore the import and export variables, sure, we should be making more things and exporting them and or selling them to ourselves and we come to this in S-World UK Butterfly – How to score a perfect 4x on the Keynes Multiplier. But for the sake of simplicity, let's ignore this for now.

3. My data is far from perfect, but the principle holds. Here is the crux of the spreadsheet that assumes 10% inflation and 1% GDP growth for three more years, not saying that’s going to happen, just saying that if it does, it is not a bad thing for the UK debt- to-GDP ratio, which if lowered would decrease borrowing costs and lessen the amount of our GDP spent on paying off existing debts in real terms. So let us see some numbers based on 3 more years of 11% inflation.

First, however, let us deal with my input assumptions, my variables, which will not be correct, but are close and the point is not the starting number and the ending number – the point is the swing.

I start with a quickly made estimate of UK GDP in 2022 at £2.6 trillion, my very basic sources were this Statista.com search suggesting £2.2T in 2021 and this Google search with sources including the World Bank (note it is in USD, and further note the rise of GDP in India) saying £2.7T in 2020, so I use £2.6T, but it may well be higher due to the 2021 figure being artificially low due to COVID.

For UK debt, I looked at two sources Statista.com and TheGuardian.com. Statista suggested £2.1T in 2020/2021 and with 2021/2022 also being a COVID year I estimated £2.5 for 2022/2023 which if 2022/2023 GDP ends up at £2.6T is close to the Guardian.com headline; Now Britain is in the 100% debt-to-GDP club, what’s the spending plan? Where £2.6T in debt and £2.6T in GDP would make an even 100%.

However, for the figures in the spreadsheet, I shall use an estimate of 2022/2023 GDP of £2.6T and dept of £2.5T for a starting debt to GDP ratio of 96.15%.

|

|

|

|

|

GDP |

£

2,600,000,000,000.00 |

2022 |

|

Debt |

£

2,500,000,000,000.00 |

2022 |

|

Debt-to-GDP |

96.15% |

2022 |

|

|

|

|

|

|

|

|

Next, I simply apply 11% inflation each year and add the estimated increase in borrowing and work out the 2025/2026 debt-to-GDP ratio if inflation is 10% a year and Real GDP growth is 1% each ear. Here is that simple spreadsheet:

|

|

|

|

|

GDP |

£

2,600,000,000,000.00 |

2022 |

|

10% Inflation + 1% Growth |

11% |

|

|

|

£

286,000,000,000.00 |

|

|

GDP |

£

2,886,000,000,000.00 |

2023 |

|

10% Inflation + 1% Growth |

11% |

|

|

|

£

317,460,000,000.00 |

|

|

GDP |

£

3,203,460,000,000.00 |

2024 |

|

10% Inflation + 1% Growth |

11% |

|

|

|

£

352,380,600,000.00 |

|

|

GDP |

£

3,555,840,600,000.00 |

2025 |

|

|

|

|

|

|

|

|

We see that in 2025, GDP would be £3,555,840,600,000.00 (£3.55T)

Now the trickier part; estimating borrowing, one can always have the possibility of an ELE (extinction level event), or another pandemic, so there can be no accurate predictions only estimated guesses. But based on current borrowing, let us take the FTs figure for Sep 2022 of £20 billion, and the ons.gov.uk Q1 2022 average figure of £15.8 billion and use £18 billion a month as our figure x 12 for £216 billion in 2022. And for continuity let's apply an 11% yearly increase to that.

|

|

|

|

|

Total Debt in 2022/2023 |

£

2,500,000,000,000.00 |

2022 |

|

|

|

|

|

Borrowing |

£

216,000,000,000.00 |

2022 |

|

10% Inflation + 1% Growth |

11% |

|

|

|

£

23,760,000,000.00 |

|

|

Borrowing |

£

239,760,000,000.00 |

2023 |

|

10% Inflation + 1% Growth |

11% |

|

|

|

£

26,373,600,000.00 |

|

|

Borrowing |

£

266,133,600,000.00 |

2024 |

|

10% Inflation + 1% Growth |

11% |

|

|

|

£

29,274,696,000.00 |

|

|

Borrowing |

£

295,408,296,000.00 |

2025 |

|

|

|

|

|

2023 + 2024 + 2025 |

£

801,301,896,000.00 |

|

|

|

|

|

|

Total 2022 + 23 + 24 + 25 |

£

3,301,301,896,000.00 |

|

|

|

|

|

And we have £801,301,896,000.00 (£0.8T)

Now we add that £0.8T to our 2022 starting estimate of £2.5T for a 2025/2026 estimate of debt of £3.2T relative to a GDP of £3.55T for a debt to GDP ratio of 92.84%:

|

|

|

|

|

GDP |

£

3,555,840,600,000.00 |

2025 |

|

Debt |

£

3,301,301,896,000.00 |

2025 |

|

Debt-to-GDP |

92.84% |

2025 |

|

|

|

|

|

|

|

|

This is still high, but it has gone in the right direction relative to our 2022 96.15%. Or as the Guardian Reported 100% (albeit if it was already 100% the figures would be different, so we must use the 96.15%.)

Further, any country that after borrowing a lot of money to pay for COVID can by 2025 move their debt to GDP level to a pre covid figure would be seen as fiscally responsible by the World Bank, the IMF and others. Of course, the same may happen to all western economies, and maybe, just maybe that’s the reason for the inflation in the first place, and once Western county's debt to GDP levels are restored below that 100% benchmark it will stop all by itself. That’s only a theory I had just now, but the figures, in general, are not.

As for right now, we need two more pieces of the puzzle, which will be presented in my next two papers, first how S-World AGI, can create a Keynes Multiplier of 4:1, simply by matching government investment of say £400 billion over 4 years. With a private investment of three times as much. So £1600 billion over 4 years.

Forget about the debate that has been going on with economists for nearly a century about the effect of the Keynes multiplier, where one tries to estimate the value of putting say £400 billion into the economy, on infrastructure projects like HS2 and the like. When you achieve a matching investment of 3:1, the collective (federal and local) tax receipts alone will add far more to the public purse than is paid out.

The last piece of the puzzle is when combining the two above into an economic strategy, the loss-averse media and other political parties will have so much good news that it more than compensates the 1:2 effect of Kahneman and Tversky's loss aversion theory, made economically famous by Richard Thaler and others. Where bad news (or threats) are twice as motivating as good news.

And with that plan, that roadmap, the very same thing that derailed Lis Truss’s vision, the third law of macroeconomics – expectations, will work in reverse and if deployed as a unified message across all parties (because S-World AGI already has Labour and the Greens votes, they just don’t know it yet), then we could see an immediate boost the UK economy and great expectations will become great history.

End of paper, except for a little bit of my debt to GDP analysis history:

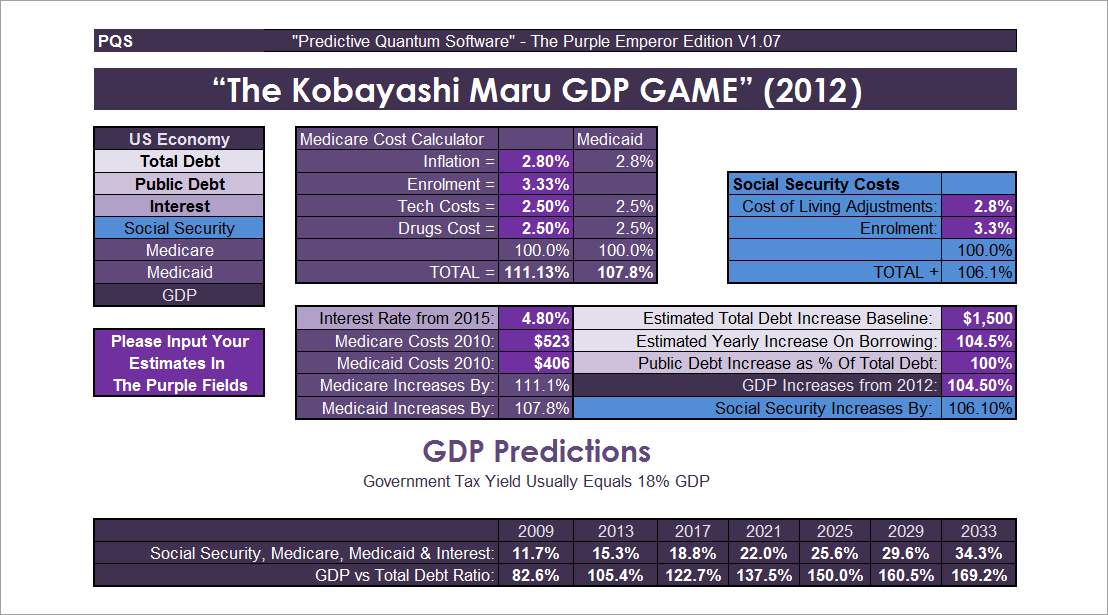

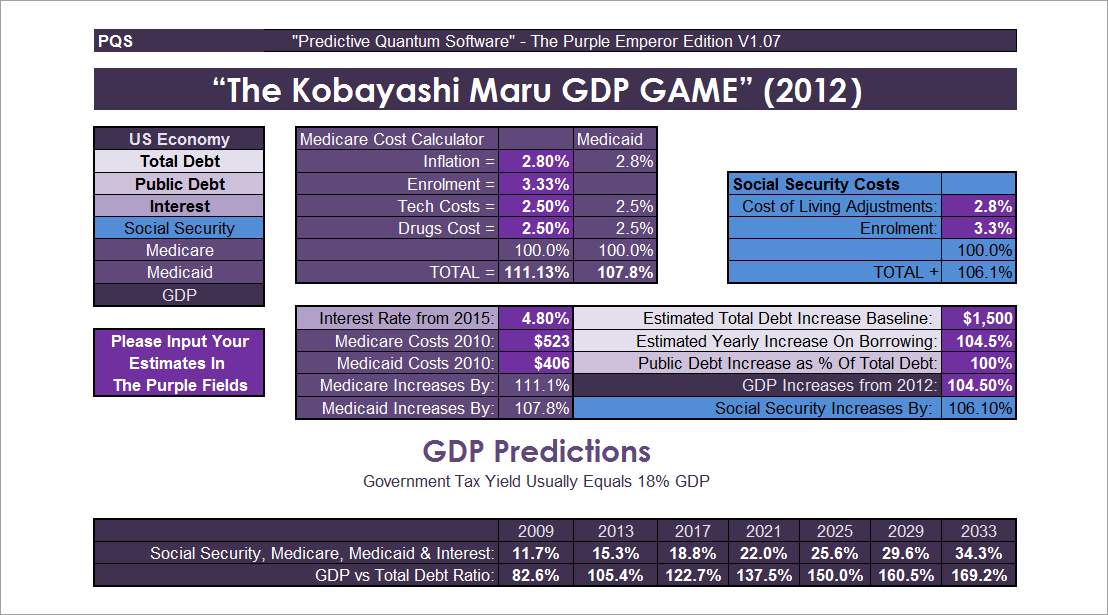

The Kobayashi Maru Debt-to-GDP Game — Feb, 2012

What do know about debt-to-GDP ratios?

As someone without an economics degree?

Well, you can say I have an instinctual feel for them, as in February 2012 without any economics training and just an hour on Wikipedia one of my first economic works, written before my first economic book The Theory of Every Business, that was improved upon in parts two and three by combining it with influences from quantum mechanics, then string theory, I created the Kobayashi Maru GDP Game spreadsheet/software; you may download it here.

As you can see below, it was a cautionary tale that focused on the Debt to GDP ratio of the US. The game was you could change 13 variables seen below in the colour light purple to see the future debt to GDP ratio, and the Kobayashi Maru was there was no way to win, except perhaps the theory of every business I was presenting in American Butterfly.

However, the game was won, and the US did not fall into the debt-to-GDP trap shown, as interest rates dramatically lowered and other factors combined to avert the catastrophe, thus far.

You will see it quickly revisited and explained in this exploratory paper from 2017, find the section – Obama Wins, and note this paper was never released. But it is the only work I have done, specifically on the debt-to-GDP ratio.

For better papers, I did release from 2017 see https://www.angeltheory.org and to see a good sample of work from 2012 to 2022 see https://nickrayball.com, but be quick because as soon as I have traction, this may well become a secret once again.

Final note, S-World AGI is not a purist AGI, it is as-if AGI.

What do I mean by as-if, well a good example is myself, and my spelling, I’ve never been officially written up as dyslexic, but to read my work without Word Editor and Grammarly you would think you were reading the work of a young child. So for sure, I am ‘as-if’ dyslexic, as you would not be able to tell the difference between me and someone with dyslexia. It has its benefits, especially in the technological age. But I’ll not get into that now.

Instead, let us just use the analogy and say that t10t (The 10 S-World Technologies) that I have developed since 2011 are ‘as-if’ AGI in that the financial and beneficial nature of them would seem to anyone who witnesses their unleashed power as if it were real-world AGI – Artificial General Intelligence. At least as far as is written in books like Life 3.0 et al.

The 10 Technologies are designed in a way that needs no innovation, as S-World AGI is a combination of AI that we know today and human intelligence that we all have. Plus of course, the spiritually and quantum gravity theory that helped inspired the S-World t10t plan.

I suggest you start looking at T7. S-RES, as presented on NickRayBall.com to see just one of the 10 technologies. But note it will be a week or maybe two before I have added all the links and written the homepage, and the best work so far – the 62 different S-World Algorithm sets are safely stored on a semi-encrypted server.

SuEc Book 1. The 10 Technologies | THE WHAT (this year’s work was created on websites, not books)

SuEc Book 2. Š-ŔÉŚ™ and The City – THE HOW Book 1. Book 2. Underlying Assumptions. 2020/21

SuEc Book 3. 64 Reasons Why - THE WHY | Complete | Summary | Basic | 2019/20

SuEc Book 4. 10x Our Future – THE FUTURE | Version 1 | Version 2 | 2020 (V1 Contains many huge chunks from Zero to One, this book was paused whilst I created this presentation for Peter Theil, which took more than 2 years and si still ongoing and is yet to be presented.

Older websites www.AngelTheory.org 2016/18 | www.Network.VillaSecrets.com 2013/17 | www.AmericanButterfly.org 2011/13

Main S-World 2022 Presentation Websites: (Login Required)

www.S-World.org | www.S-Web.org | www.The10Technologies.com | www.NickRayBall.com

Note that each of the ten technologies has a dedicated website, found in the dropdown link The 10 Technologies. Most however are works in progress that will be ready, in a basic format, presenting relevant links and a basic homepage in Q2 2023. (Login Required)

For the best version of the work from 2011 to 2022 that is available to the public, this link from mid-2021 presents most of the PDFs and some of the weblinks created: https://nickrayball.com/2011-2021.php.

Next, Generation

African Development Economics &

AGI Design

Some S-World Technology 1. S-Web™ Websites:

www.CapeVillas.com | www.ExperienceAfrica.com | www.CliftonLuxuryVillas.com | www.MalibuBeachVillas.com

Historical Websites:

www.SuperEconomics.AI | www.AngelTheory.org | www.Network.VillaSecrets.com | www.AmericanButterfly.org

+44 7387 394 298

Email: Nick (then at) NickRayBall.com

https://twitter.com/NickRayBall

.png)