S-World AGI — US$ 1039 Trillion — Original

S-World™ AGI

Initial Note by Nick Ray Ball December 12th, 2022

Hi there,

Well, if you are looking at this page you have probably come from the basic version. I'm busy today but did note that I did not load this page onto this website until today. The reason for this is was because it was not completed and does not end as I would like it to. But as it does have data that is relevant to the basic page, in that the basic page is an edit of this page, it makes sense to add this page and just add this warning, so I have.

Enjoy.

Sincerely Yours,

Nick Ray Ball

Also note, most of this was worked out in 2020, and I’m right now working on a document that present’s that work:

I will try to add a link to it, if not it will be on the menu. With a title similar to: 14.59__SuEc__S-RES_and_t10t__Books -2019-to-2022__(Dec_12_2022)

https://nickrayball.com/$1039_Trillion_BASIC.php

https://www.s-world.org/$1039_Trillion_Original.php

Š-ŔÉŚ™2021—⌂≥ÉL.

How Š-ŔÉŚ™ Generates US$ 1039 Trillion by 2080

Taking Malawi from Zero to One Percent of GDP

A Supereconomics Story

Click here for the shorter version of this page.

Below we see a simple diagram of a bath tub in which the amount of water flowing into the bathtub is equal to the amount of water flowing out. (Note the out-flow at the bottom is 10x magnification.)

.jpg)

Next we see that if 90% of the water was recycled - the total amount water enjoyed by the bath increases from 80 to 152 Gallons.

.jpg)

Of course in this case the water would overfill and spill onto the floor, which is not desired.

But what if we exchange the water for money?

Next, we see the same situation but with money.

In 2024 a network of businesses has $6.32 billion in savings and revenue (Š & Ŕ) of which 90% is spent on goods and services from other businesses or personnel in the same network.

Which at an 'É' (recycle-Éfficiency) of 90% increases the cash flow as follows;

The initial $6.32 + the recyled $5.68 billion = $12 billion.

However for this exercise, for History 3 (the simulation we are analyzing), we report only the pre Śpin income, which when some other items are added and taken away equals $5,685,975,000.

We will see this figure appear as the first entry on the 2024 to 2080 History 3 cash flow statement presented shortly

.jpg)

Now we apply Śpin (Ś) to the 2025 figures . As before instead of spending the money once a year, we spend it twice creating $14.89 billion in cash flow. Plus, critically, $7.10 billion remains at the end of the year, and is transferred to 2026, this is called Šavings (Š) or sometimes The Law of Conservation of Revenue

The following year (2026) Śpin increases to 3, so we spend the money three times in a year creating $26.85 billion.

Note the figures are effected by aditional in and out flows and they wront tally without them. To see the additional 'in and out flows' go to: 11.11__S-RES__BASIC

The Š-ŔÉŚ Equation

High-Octane Financial Engineering

Pecunia, si uti scis, ancilla est; si nescis, domina.

(If you know how to use money, money is your slave; if you do not, money is your master)

History 3 - Malawi Network - 2024

Now let us look at this on the spreadsheet

To download the spreadsheet follow this link ; Download Spreadsheet 8.62b .

(You may find your anti virus warns you not to open this, you may ignoor this warning, or contact us and we can email it to you, either way the spreadsheet is important.)

Below we see The Š-ŔÉŚ™ Calculator in Year 1 (2024)

Revenue and Savings in red x 90% É x Śpin 1 = $5.68 Billion (USD), which takes 365 days.

This $5.68 billion is divided as Ť (tenders) between 2,048 businesses who each receive an average of $2.77 million.

At the end of the year, the $5.68 billion in the networks central bank converts to Š (savings) to re-emerge as cash flow in 2025

History 3 - Malawi Network - 2025

Next, we see year 2 savings and revenue are $8.56 billion and Śpin 2 forces all the cash flow to be spent before 11th July 2025.

É is now 91%, so 91% of the cash flow remains in the central bank, transferred from one network company to another, and another, in a process called The Sienna Equilibrium. (a next-generation spreadsheet for this is in progress.)

On the 12th of July, the cash flow remaining in the bank, now $7.75 billion is again distributed to the now 4,096 companies averaging $3.63 million each, to be spent before the end of the year, again with an É of 91%. At which point $7.09 billion remains in the network central bank and it converted to Š (savings) in 2026.

On the 12th of July, the cash flow remaining in the bank, now $7.75 billion is again distributed to the now 4,096 companies averaging $3.63 million each, to be spent before the end of the year, again with an É of 91%. At which point $7.09 billion remains in the network central bank and it converted to Š (savings) in 2026.

Essential to know, the businesses in the network use the Ten Technologies software to set prices and handle all but petty cash accounting. There is a massive amount of detail for this software.

History 3 - Malawi Network - 2032

Now we can really start to get a handle on the Š-ŔÉŚ™ process and see its magic.

Moving now to 2032, we see É is now 99% (which may be higher than can be achieved, but with 8 years of practice, we would get close).

With an É of 99%, the amount of cash flow lost to É (spent on raw materials, goods and services from companies outside the network.) is minuscule.

Note the Spend By Dates, the initial cash flow is spent in the first 42 days, the second Śpin is also 42 days then; 41, 41, 41, 40, 40, 39, 39 days. Eight Śpins generating $106 billion in cash flow, and about half that in GDP.

Note the Spend By Dates, the initial cash flow is spent in the first 42 days, the second Śpin is also 42 days then; 41, 41, 41, 40, 40, 39, 39 days. Eight Śpins generating $106 billion in cash flow, and about half that in GDP.

This figure is then halved because of the CFV (Cash Flow to GDP Variable) at 50% the CFV considers the GDP double-counting problem presented in David A. Moss's; A Concise Guide to Macroeconomics.

Like Einstein’s cosmological constant, this may seem unnecessary, but in the end game become necessary.

In this year, 2032, we are now dealing with 24,576 businesses in the network, each on average with 32 personnel creating 786,432 very high salary Jobs. (Before the many allocations the average wage plus bonus is about 80 times the average income of a Malawian. (when calculated using World Bank 2019 Malawi GDP per Capita as income.)

History 3 - Malawi Network - 2048

In 2048 we move É to 99.5% - now the cash flow is circulating every 14.5 days.

History 3 - Malawi Network - 2080

I stop incresing Śpin at Śpin 32 in 2055, and we see Śpin 32 with an É of 95.5% continue untill 2080 at which point cash flow is $8,204,082,483,521 and GDP is $4,102,041,241,761 in the year 2080. We will see this figure discounted later in this presenation.

What is

"Increasing The Money Supply?"

It is the job of central banks to regulate the economy, one part of this is increasing or decreasing the money supply.

In days gone by, if inflation got too high, the central bank (The Fed, The Bank of England, etc.) will decrease the money supply which usually has the effect of decreasing inflation as less money means less spending.

Inversely after the 2007/9 crash, to increase the money supply the central banks decreased interest rates, to almost zero, and most or many central banks still have just above zero rates today, thus other methods of increasing the money supply have become more mainstream since the 2008 crash.

Quantitative Easing

Many will have heard of Quantitative Easing, where essentially the central bank creates more of its own currency and uses the money to buy back government bonds from banks which allows banks to lend more money.

MMT - Modern Monetary Theory

In her book The Deficit Myth: Modern Monetary Theory, Stephanie Kelton presents MMT (Modern Monetary Theory) MMT advocates that increasing government debt by say $1 Trillion (an increase of about five percent) is not a bad thing because it creates one trillion US dollars in whichever sectors/states are chosen as recipients of this new (additional) money.

Note that MMT only works for countries that have their own currency and works best for countries with their own strong currency, like the UK, Japan, Australia, Canada, China of course, and a few others.

Fractional Reserve Banking

Another method which is closer to S-RES in principle

is called Fractional Reserve Banking.

Investopedia.com , FederalReserve.gov , Wikipedia.org .

Note that we await a Nobel ranked economist to word this next point, my presentation is just giving the basic idea.

In Fractional Reserve Banking, or as I used to say; The RRT (Reserve Rate Technique) banks are required to hold only a fraction of the deposit, often 10%.

Of the money deposited the bank can lend out 90%, if that 90% was in turn put in another bank, that bank could do the same and see an increase to the money supply of 90% of 90% being 81% added to the original 90% = 171% increase to the money supply. If the process happened again it would add another 72.9%, so now the amount of money in circulation is 171% + 72.9% = 243.9%, and if we went as far as we could we would see an increase in the money supply close to 900%. This process is not dissimilar to how the Éfficiency and Śpin work in Š-ŔÉŚ™ where É creates the 90% and Śpin forces the re-spending.

I'm going to go out on a limb here because I've not heard this hypothesize from others, this quality of US banking, plus quantitative easing, derivatives, inflation manipulation, plus all other methods used to increase the money supply over the past two-hundred-years, may have increased the money supply in the USA by a magnitude, from $2.9 trillion (like Great Britain today) to the $20.9 trillion the World Bank reports for the USA in 2020.

Exact figures aside the USA's ability and execution of various methods of increasing the money supply on a macro scale has worked.

And this is a leading contributor to the USA's GDP figures today

So consider this, if various ways of increasing the money supply may add a magnitude to US liquidity today, then it’s perfectly reasonable that Š-ŔÉŚ™ - the next and last mover in increasing money supply can increase the money supply and so GDP of any country it assists, and to coin a phrase move Malawi from 'zero to one' percent of GDP.

Now we understand a little more about the benefits of a positive money supply to a country, we can better marvel at the 32x (3200%) that Š-ŔÉŚ™ can create.

Equally appealing is that Š-ŔÉŚ™ is a lot safer than Fractional Reserve Banking, because in Fractional Reserve Banking the 10% or less (now its apparently zero), held by banks, creates the environment for a bank run if more than 10% of customers want their money back at the same time.

Š-ŔÉŚ™ on the other hand is fundamentally different because the money in circulation never leaves the bank.

To understand this, we need to bring in one of the underlying assumptions: Network Credits.

Network credits are simple - they are essentially gift-vouchers for an individual store, or service which have a 'must spend by date'.

One network credit is worth one US dollar.

Essentially network credits are quantized, they can be counted, we will always know where each network credit is. If there are $100 billion network credits in circulation, the network central bank must have all $100 billion US dollars in its vault, or more often US treasuries, which are bonds that pay about 1.5% percent interest each year.

So now consider the process.

Company 1 spends 90 to 99.5% of all its network credits on its personnel, municipal personnel, services and other companies in the same network, then Technology 2. The TBS™ (Total Business Systems) immediately re-spends as many network credits as it can, in the same way, all 2048 companies must spend all their network credits before the next Śpin. These exchanges are lightning-fast, unusually the whole process will take just a few nanoseconds.

However, if you were to take a snapshot in time, you would find the money in one place, or another, companies will either have money or they will have bought materials and paid staff who will go on make money before the beginning of the next Śpin.

The result is there is no point when the companies are credited with having more money than is sitting in the vault of the central bank.

So if the music stopped, and everyone who was supposed to have money had their money, there would not be a line of other companies waiting for their money, there cannot be a bank run with this formulation of Š-ŔÉŚ™ - ÉL aside, the money never leaves the central bank.

This is best presented in the unscripted History 2 video, my favourite S-RES video includes trade and takes Malawi from zero to one percent of GDP 29 years earlier in 2051.

Plus it battles 15 years of simulated recessions and a depression in which all world trade stops, and yet just by good management of Š and adjusting É and Ś the network increases its cash flow every year.

See:

Ad Libbed (27.20 Minutes) (27th Dec 2018)

There is a very detailed program called The Sienna Equilibrium that maps out company-to-company spending, I paused this work a couple of months ago to bring you www.S-World.org. I shall return to The Sienna Equilibrium once this website is completed and I have finally sent the presentation to Erin Gleason Lane, Lauren Gross and Peter Thiel @Founders Fund.

Next we return to the no-trade History 3, and the figures from the S-RES Calculator Spreadsheet Tab: 'H3) ŠÉŚ-v5 | S-World History 3b' from 2024 to 2080.

With Śpin increasing by one each year for the first 32 years.

Š-ŔÉŚ™ History 3 - 2024 to 2080 - Discounted Cash Flow.

So far, we have shown the Š-ŔÉŚ™ powered Cash Flow in the years; 2024, 2025, 2032, 2048 and 2080, below we see the cash flow in each year from 2024 to 2080, as seen on spreadsheet tab; H3) Total Cash Flow & GDP .

After we add it all up cash flow equals $140 Trillion, but for this figure to have any meaning we need to discount it.

.gif)

The discounting method I have used is simply to change the 4 growth variables at the top of the H3) ŠÉŚ-v5 | S-World History 3b spreadsheet to Zero, which gives us a figure of $23,321,291,435,916.

Next, we apply the CFV of 50% making $11,660,645,717,958.

That is Malawi's discounted GDP from 2024 to 2080 as it climbs from zero to one percent of GDP.

Critically, History 3 only includes some token trade figures, so in terms of global expansion/implementation, it's a non-zero-sum-game, almost all of that GDP is made and then consumed in Malawi, Malawi is not competing with South Africa, Tanzania, or anywhere else. And because of this, the model could be repeated over and over in different locations, just so long as each location can find a persistent buyer for at least one suburb.

At the very least, we should try for another 24 countries in Africa, but ideally every country in Africa. Add to that 25 Grand Śpin Networks in US states and other countries in the Americas, 15 in Europe, 15 in Asia and 10 others including Australia and New Zealand, making 99 others Grand Śpin Networks.

So we multiply the Malawi figures by 100 giving us $1,166,064,571,795,800 ($1,166Trillion)

Below we can see precisely how many companies there will be in year 1 (2024). Stating with 2,048 companies in the year 2024 rising to 327,860 companies in 2080. We also see how much they each earn and how many Paid2Learn places they create.

Note the figures are not discounted.

Let’s take a moment to analyse this spreadsheet.

Staring on the left column ‘C’ presents the data we just saw on the last spreadsheet, the cash flow in that year.

Next, we find the expansion of companies, this was done by hand, seeking to follow the POP pattern first seen in History 1. (More on this in the underlying assumptions)

In a great simplification/symmetry labour receive 25% of cash flow, note however I am weighing up the consequences and may increase this to 50%. But for now, it's 25%.

In column ‘G’ we see total labour cash flow, then in ‘H,’ we divide that between 32 persons in a company, column ‘I’ then calculates the amount of staff (from janitor to CEO), and in ‘J’ we see average staff salary at £21,690, which does not sound like much, but it is in fact about 80 times the average per capita income in Malawi in 2018.

Note that these figures are not discounted, so for salaries and company cash flow focus on 2024 and 2025 figures.

Discounting does not affect the number of companies or the number of jobs.

In column ‘M’ we start to see the Paid2Learn initiative, which is simply to pay people, not a lot, but enough so they can go into full-time learning, be that to becoming a footballer, tennis star, or other local sports star, becoming an artist, scholars or training for a job in one of the many S-World businesses.

Alongside Technologies 1 to 6 Paid2Learn deals with training and recruitment plus education from kindergarten to PhD.

A key note for Melinda Gates; about half of labours salary is allocated to bonuses, be that S-World UCS™ Hawthorne making a daily competition for the staff in the many businesses, or in Grand Śpin Networks many sports leagues, then, critically in competitions, girls on average win more cash bonuses than boys, be their speciality physical or academic.

There are a great many variables based on performance and other things such as, controversially, how many children one has. So, a mother or father of three will lose maybe 5% and a father of four may lose 10% and less controversially I hope that being a woman gets a positive 5%. So, on average women are paid 5% more than men.

The point here is to reverse the current economic status quo that, certainly in poor locations, girls are economically valued less than boys. This is no small thing, in one of the books; Poor Economics or Why Nations Fail the Nobel winning authors from MIT tell of 100 million missing women. That I believe is the biggest case of genocide to date. However, by reversing the economics to girls are more profitable than boys, I hope that together, we can stop the next 100 million tragedies, or more likely 200 million due to population growth in Africa alone this century.

Currently Paid2Learn receives 25% of labours salary which is then split between 4 people. Thus each Paid2Learn Trainee is paid 6.25% of £21,690 which equals £1,355.63. Now this is small, but as I mentioned at the time (2018) GDP per Capita in Malawi was the lowest in the world at $250, and so £1,355.63 was probably enough to get by on. Since then Malawi has boomed up to about $500, which make me think that if we divided by 2 people, not 4, that number doubles to £2,711.25, which offers more dignity, remembering also that Paid2Learn will become social security.

Very important are the 14 different ways to increse cash flow, .

Equally, or maybe more important are the 6 ways to increse or decrease cash flow, but I cant find the narative right now so we shall come back to rhis point later, for now one is to simply make half as many companies as we see in the spreadsheet, This can result it can double gdp, which in turn can double salaries or increst investor ruturn.

There are another 5 such tricks/techniques for dobaling or haling cash flow, for now here are the14 different reasons why S-World businesses out shine standard businesss.

, or if you make only a quater of the of the amount of comoanes it .

Fourteen Reasons Why

S-World companies will outperform classical companies.

- Each business starts with world-class technology and systems

- S-World Film creates superior films and Stills for products and social media and seeks to make Hollywood films (some real, some not) about S-World.

- At the Ťender level sales and marketing costs are zero

- Rent – Zero (each company owns its own real estate)

- Warehousing costs low to zero (Warehousing is owned by the company)

- Business Rates and Property Taxes – Cost Zero

- VAT between two network companies – Cost Zero

- CFO – Chief Financial Officer, Accounting, Auditing – Cost Zero, or much less than normal for more complex or massive companies.

- Other C-Suite Personnel – Less needed, if any are needed at all.

- Economies of scale in a market worth $23 trillion. (It's massively cheaper per home to build 10 million than it is to build one.)

- Network Effects – Super internalities, The Ast⇔Bst find and create opportunities within the network.

- Net-Zero DCA works out what new types of business will do well in the network.

- Efficient Suppliers, goods and services from other networks in the same company are guaranteed to be, high quality and competitively priced.

Imagine if Amazon assessed every product for sale, and only allowed the best few products to be sold. That’s what is desired here, for each product, such as an Aluminium Window we search the world for the product that’s not the most expensive, but that is, as good or almost as good as the most expensive, which can be produced at scale for the same price that a standard Aluminium Window costs. Equalling a good price, and exceptional quality.

For each product including patents, technology, the current company gives the Malawi Grand Śpin Network company the rights to manufacture the goods, and for the first year or two provides technical assistance, such as a manager moving to Malawi and set up and run the company for the first few years. Or a virtual production line as is described in Chapter 7. Grand Śpin Networks.

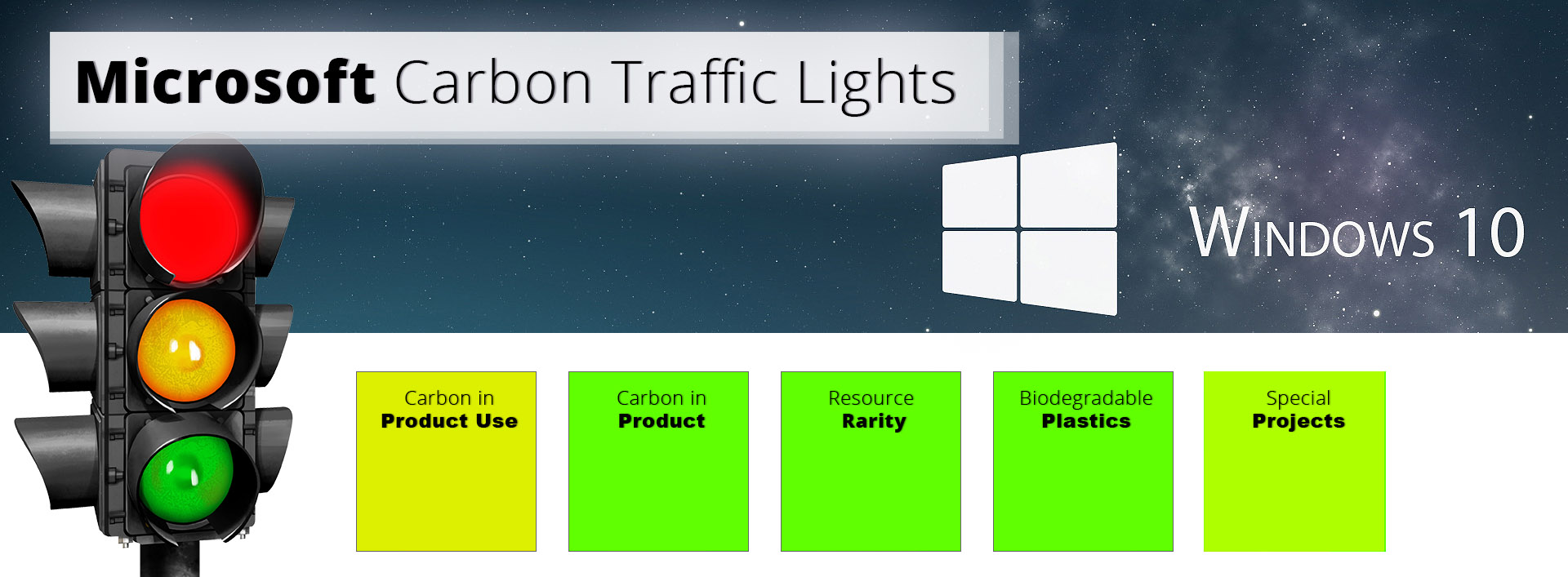

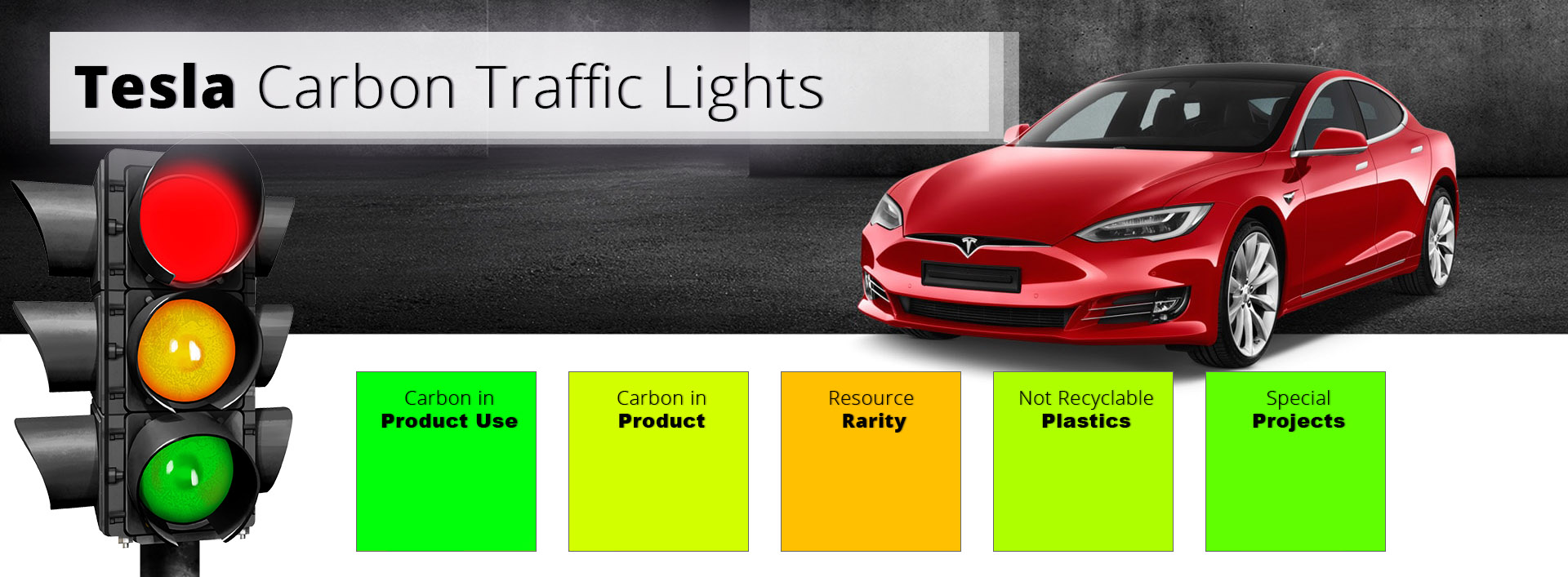

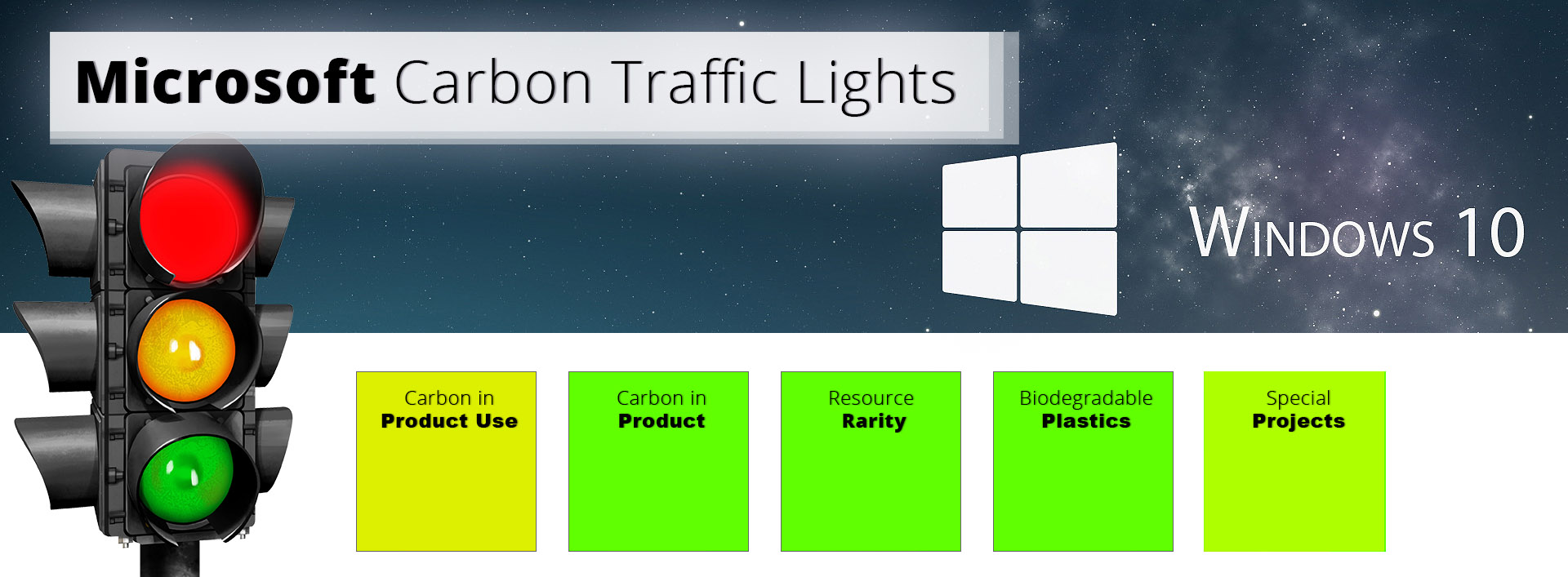

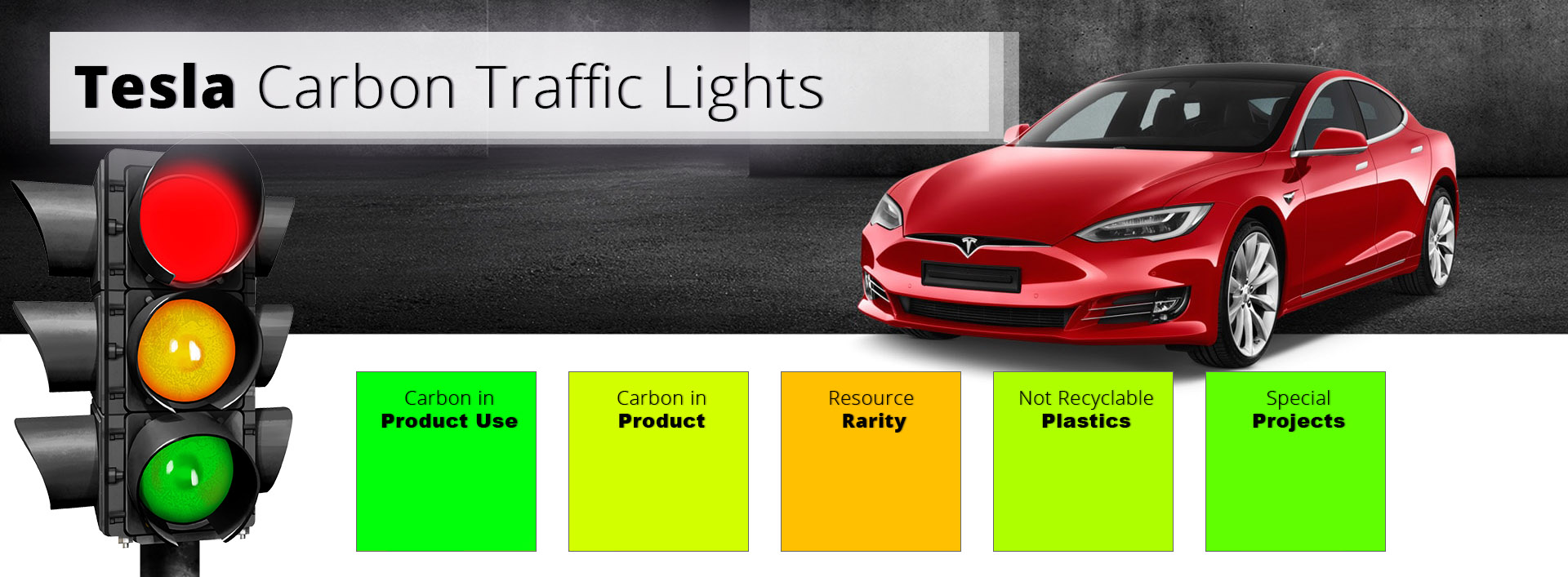

- Carbon Traffic Light Scores – Each companies CO2 and other ecological footprint is assessed by the Carbon Traffic Light Team.

WE have now come to the point that Tax Symittry (Technolgy 8 Net-Zer DCA Soft.) must be discussed,

The origional Tax Symmetry

In place of standard taxes, the government are paid in output, we do not pay $2 billion for the infrastructure we build 2 $billions worth of infrastructure, at a price far lower than a contractor would have.

18.25% of all cash flow is allocated to the government and 75% of all cash flow is spent on creating special projects from Book 1. 64 Reasons Why on items that the government would love to give to its people if only they had more money.

In addition, the S-World TBS™ (Total Business Software) ensures there is zero tax avoidance or evasion, quite the opposite as companies gain valuable S-World UCS™ points for paying higher tax. For generating more cash flow to be spent on projects on the government's list, such as social housing and infrastructure, solar arrays, schools, hospitals and so on.

Tax Symmitry & Net Zero DCA,

To explain Dynamic Comparative Advatage let us here from Nobel Lariette Joseph Stiglits

In some, and probably most cases, the businesses in the network can make more of their products and services to sell outside the network. Exports to Southern African Counties a major market, plus of course other Grand Śpin Networks all over the world.

Let me draw attention once again to the circular nature of the decision to buy a suburb. Because one is buying a suburb, the Grand Śpin Network owners create a determined path to riches so massive they are recorded as a percentage of global GDP.

Because we have taken away all income except the Suburb Sale revenue, we can make predictions with certainty, so long as someone buys a suburb, and we can use Š-ŔÉŚ™ as prescribed and the returns will be as presented.

The only critical variable is 'Can We Find A Buyer Or Buyers For A Suburb Sale?'

The Malawi Grand Śpin Network Companies Cube (2048 Companies in the year 2024)

Above We can see a clear message to Elon Musk with 7 cubes assigned, and in addition, Microsoft, Facebook, Google, Berkshire Hathaway and Virgin get a place on the board, all of which create products that are essential to the special projects, and are themselves special projects at least in terms of carbon. The rest of the board is filled with special projects and facilitating systems such as the Peet Tent.

Whist this runs out of sequance, lets have a look at the UK version on the above.

Part 2 – Determined Cash Flows

Š-ŔÉŚ™2021—⌂≥ÉL.

The idea here is that we now throw away all revenue except the sale of city suburbs and consider the buyer for a suburb. If they buy a suburb at $1 billion a year plus 5% PA escalation, for at least 16 years then that revenue multiplied by Š-ŔÉŚ™ creates determined cash flows, like we see below, made from spreadsheet tabs S-World History 3 ⌂ = 100% and Total Cash Flow & GDP ⌂ = 100%.

There are two different types of determined economics at play here, first is for the buyer of a Suburb, second is for all the businesses in the Suburb. Both are 'combinatorial' - meaning they can interact with each other and other technologies and become far more than the sum of their parts)

.gif)

For the buyer of a suburb, their success is predetermined.

All the businesses in the Suburb are determined because the cash flow Š-ŔÉŚ™ creates is distributed to the S-World businesses. This income in all but the rarest of cases be sufficient to pay all bills, wages and bonuses.

Over the last 12 months, a lot of time has been devoted to making this system determined, and the following equation has been created for this purpose ⌂≥ÉL.

The equation reads as follows;

⌂ = The Suburb Sale

≥ = must make the same or more than

É = recycle-Éfficiency

L = Leakage

The Suburb Sale (⌂) must make the same or more than (≥) recycle-Éfficiency (É) Leakage (L)

The 10 Technologies

Brand Names and 'x' Forcasts

.jpg)

Technology 8.

Net-Zero DCA and Tax Symmetry

Tax Symmetry

S-World Net-Zero DCA Soft.

(Dynamic-Comparative-Advantage Software)

Thank you for Reading:

"How To Make 1039 Trillion Dollars"

Š-ŔÉŚ™2021—⌂≥ÉL.

.png)

.jpg)

.jpg)

.jpg)

.jpg)

On the 12th of July, the cash flow remaining in the bank, now $7.75 billion is again distributed to the now 4,096 companies averaging $3.63 million each, to be spent before the end of the year, again with an É of 91%. At which point $7.09 billion remains in the network central bank and it converted to Š (savings) in 2026.

On the 12th of July, the cash flow remaining in the bank, now $7.75 billion is again distributed to the now 4,096 companies averaging $3.63 million each, to be spent before the end of the year, again with an É of 91%. At which point $7.09 billion remains in the network central bank and it converted to Š (savings) in 2026. Note the Spend By Dates, the initial cash flow is spent in the first 42 days, the second Śpin is also 42 days then; 41, 41, 41, 40, 40, 39, 39 days. Eight Śpins generating $106 billion in cash flow, and about half that in GDP.

Note the Spend By Dates, the initial cash flow is spent in the first 42 days, the second Śpin is also 42 days then; 41, 41, 41, 40, 40, 39, 39 days. Eight Śpins generating $106 billion in cash flow, and about half that in GDP.

.gif)

.gif)

.jpg)